There’s a typical trajectory for many maker businesses: You’re crafty and like making things, and friends and family start asking if they can buy what you create. Your first sales are to people you know, then you make your first sale to a stranger. Maybe you participate in some craft shows, open an Etsy shop, put up a website… And then you wonder: When does your hobby turn into a business? At what point do you have to start charging taxes?

We’re going to fill you in on when and how to charge sales tax as a maker in Canada. But first, a little bit about what that even means.

What’s the difference between PST, GST and HST?

Let’s start with the ST part: sales tax, meaning a tax paid as part of a retail transaction. It’s different from things like income tax (paid on income) or property tax (paid by property owners).

In Canada, there are a few different types of sales tax: provincial sales tax, goods and services tax and harmonized sales tax. Depending on where you live and who you sell to, you’ll have one or a combination of these to contend with. These taxes won’t exactly be new to you – they are charged on most goods and services made in Canada, with a few exceptions (like some grocery items).

Businesses are responsible for collecting sales taxes on the goods and services they sell, and for passing along the money that they collect to the government. Sales taxes are calculated as a percentage of the item being sold. For example, if the product costs $100 and the province charges 13 percent HST, the tax on the item is $13; the customer pays a total of $113.

Provincial sales tax – PST is the sales tax charged by each province (except Alberta), and the amount is different depending on where you live. The rate ranges from six percent in Saskatchewan up to 9.975 percent in Quebec, where it’s called the Quebec Sales Tax. Manitoba calls it RST (retail sales tax).

Goods and services tax – GST is the sales tax charged by the federal government and is five percent of the price of the item being sold.

Harmonized sales tax – Some provinces — New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island — have combined their provincial and federal sales taxes into one “harmonized” tax. Businesses in these provinces need to calculate and charge only one tax.

In Quebec, the GST is managed by the province, instead of the federal government, and it’s handled a little differently than in the rest of the country. You can find more information and the required forms on the Revenu Québec website.

In some Indigenous communities, rather than the GST, businesses collect the First Nations goods and services tax, or FNGST. For more information about where this tax applies and whether you need to register for and charge it, along with other details, visit the First Nations Goods and Services Tax page on the Government of Canada website.

(The above rates were current as of publication, but it’s a good idea to check the Government of Canada website for the most up-to-date information.)

Do I need to charge sales tax?

Whether you charge tax on your products depends entirely on how much money you make. If your revenue is $30,000 or less in a year, you’re considered a “small supplier” and do not need to register for or charge GST/HST.

As soon as you break that magical $30,000 number, though, you need to register with the government. If you think you’re getting close, it’s a good idea to sign up.

Keep in mind that in this case, a “year” isn’t necessarily a calendar year, a.k.a. January to December (though it could be). The government looks at your total revenue in any four consecutive quarters. That could mean, for example, from July to the following June. It’s your responsibility to keep track of your revenue and register no later than 29 days after reaching the milestone. (It’s one of the many reasons to do your bookkeeping on a frequent basis.)

Your revenue is the the total amount of money you bring in from sales of all your products, before subtracting expenses and other deductions. It does not include money that you might make from an unrelated full-time or part-time job. However, if you’re running two businesses as a sole proprietor, and each one makes $16,000, for example, you would have to register because your total revenue as an individual is above $30,000.

An important note: don’t charge sales tax if you’re not registered and don’t have a GST/HST number. You can, if you want to, register voluntarily and charge tax even if you don’t make more than $30,000 — doing so allows you to claim back some of the tax you pay on your operating expenses and the supplies you buy.

How do I get a GST/HST number?

Getting a GST/HST number is almost as easy as setting up an Instagram account: Visit the Government of Canada's Business Registration Online website here, and follow the steps to register for a business number, which will then allow you to register for a GST/HST Program Account.

You’ll need to have your social insurance number and postal code handy, as well as be ready to input basic business information, such as your business name, address and primary business activity. You’ll also want to be prepared to share how much your total sales are for the year, the “effective date of registration” (the day you started or will start charging GST/HST), your “fiscal year-end” (usually Dec. 31) and your “reporting period” (the periods of time for which you file your GST/HST returns; businesses making $1.5 million or less report annually).

If you live in a province that has GST (not HST) you will need to register for PST separately. Visit your provincial government website and look for its section for businesses to find out how.

How do I start charging GST/HST?

First, determine the tax rate for your location, then start adding it to your prices every time you make a sale. Most makers will need to charge tax on everything you sell, unless you sell items that are “zero rated” (a very short list).

If you sell online, ecommerce platforms have a place where you can set your tax rate so it’s automatically calculated on every sale. Check the platform’s help documentation on how to do this. (Here are Etsy’s, Shopify’s and Squarespace’s, for example.)

Likewise, if you use a payment processor like Square for in-person sales, you’ll also be able to enter the tax rate within the software so it’s automatically calculated. For cash sales, you’ll have to manually calculate the total with tax, and be sure to keep detailed records for your files. The calculation will look like this: price of item(s) + (price of items x tax rate) = total. For example, if you sell two mugs at $30 each and you’re in Nova Scotia, you would charge $60 plus 15 percent HST of $9, for a total of $69.

One thing to keep in mind: The tax rate you charge to a customer depends on a rule called “place of supply.” For in-person sales, this is easy — it’s the province you and your customer are standing in. For online sales of physical products, though, the relevant rate is the place of delivery. In other words, if you’re in Manitoba but you’re selling to a customer in Nova Scotia, you need to charge the Nova Scotia sales tax rate. If you’re selling via a major ecommerce platform, they should have these calculations built in. And on a related note, if you’re selling online to a customer outside of Canada, they won’t pay sales tax at all.

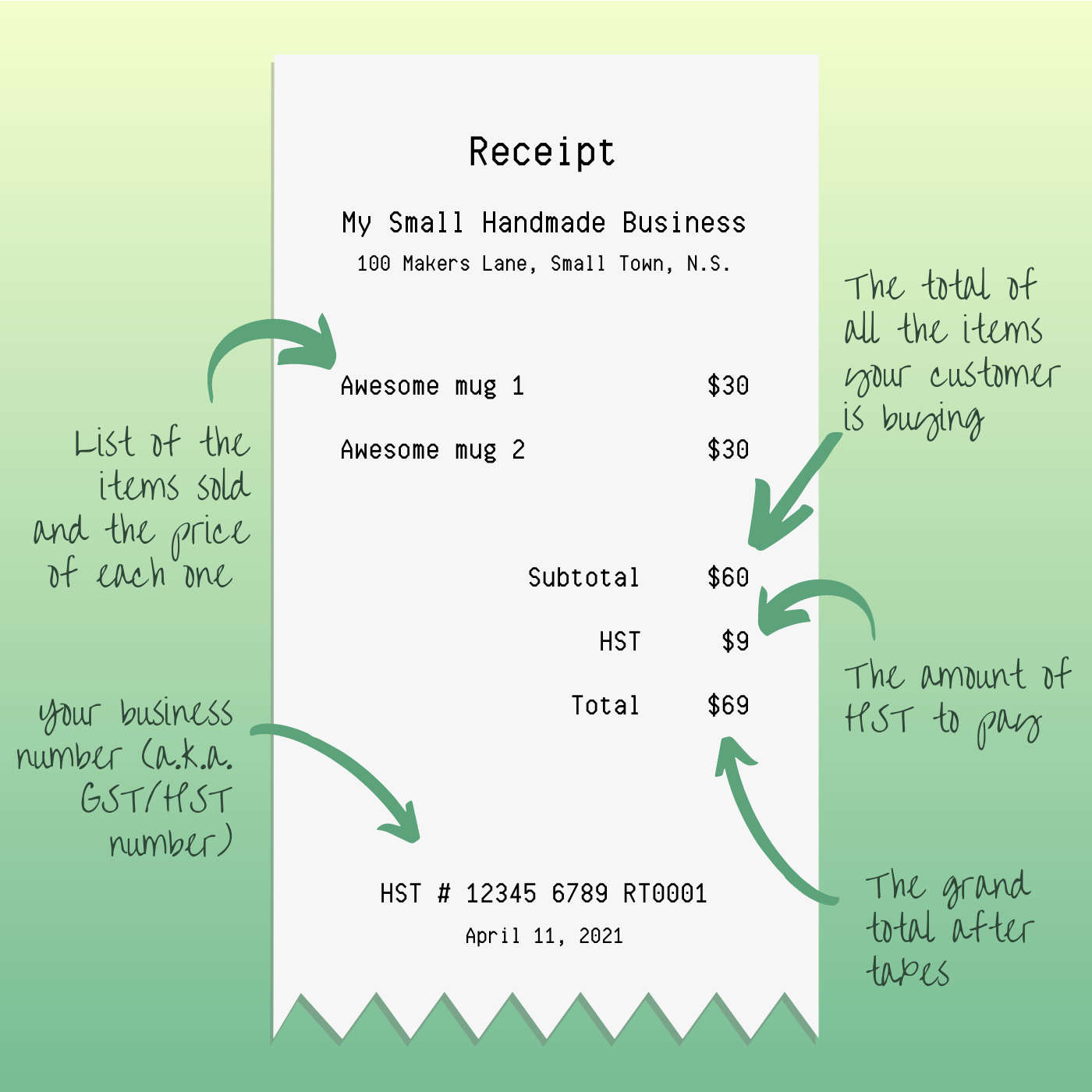

When you collect GST/HST, you’re obligated to tell your customers that you’re doing so. Most commonly, this is done on the receipt or invoice. Include the price of the item, the amount of tax and the total. It’s also a good idea to include your business number (which you might think of as your GST/HST number) to show that you’re legally allowed to collect tax.

If you prefer round numbers (which can make selling at craft shows easier), you’ll have to notify buyers either on the receipt or with a sign that your prices include tax. You’ll then have to deduct the tax from the sale price when you’re calculating how much tax to pay the government. For instance, if you’re in Alberta and charging $20 including GST for an item, that’s a simple 20-dollar bill for the customer. But from the government’s point of view, it’s $19.05 plus $0.95 GST.

What do I do with the money once I’ve collected it?

One Big, Very Important Point: the tax you collect is not your money! We can’t stress this enough. You are collecting this tax on behalf of the Government of Canada and it’s their money — they’re going to get it eventually. And if you’re late submitting it to them, they will charge you interest.

You’re obligated to report how much GST/HST you’ve collected each year when you file your annual GST/HST return (or quarterly, if you make more than $1,500,000), and to transfer that money to the government within the time frame they specify. Talk to your tax preparer about how to file a return.

Similar to the Canada Revenue Agency My Account for Individuals portal that you can access online to view your income tax balance and make payments, there’s a business version called My Business Account. Once you register and log in to the portal, you can file a GST/HST report, view your balance and make payments. You can also make payments through your bank or by mailing a cheque.

One trick many small business owners use is to keep the sales tax they collect throughout the year in a separate bank account, so they have it set aside for when it’s time to pay and aren’t tempted to spend the money. Another option is to make more frequent payments, like monthly or quarterly. However you prefer, just don’t spend it!

Note that under certain conditions, the government may decide that your business should be submitting payments quarterly rather than annually. They may not warn you before you’re required to make quarterly payments, so keep an eye on your account or ask a professional what your requirements are.

If you think you might be getting close to having to charge sales tax, it’s a good idea to talk with your accountant or tax preparer. Find out if there are any special considerations for your business, your location or the types of products you sell, and what you have to do to fulfill your tax obligations. It’s pretty straightforward, but you definitely want to stay on the right side of the law!

And if you have other questions, remember, the CRA is only a phone call away.

Tell us: what questions do you have about charging and collecting sales taxes in Canada?

*The information in this article is accurate as of its publication date. For the most up-to-date information, please refer to the relevant government websites.